Southeast Asia Pay Outlook 2026 – How Vietnam Compares

Southeast Asia Pay Outlook 2026 – How Vietnam Compares

This article is written in English for readers in Vietnam. Vietnamese and Japanese translations are available on our website.

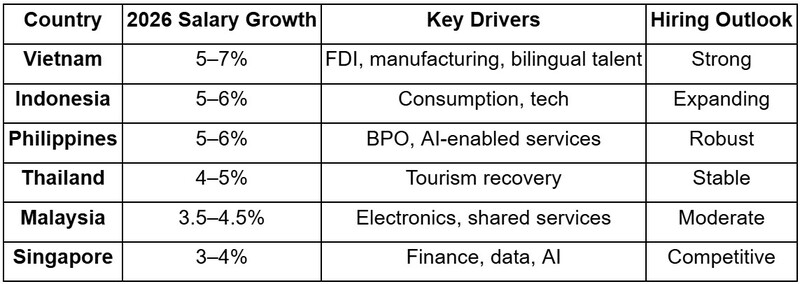

🌏 1. A Regional Snapshot: Salaries Rising 5.3% Across Southeast Asia

According to the AON Southeast Asia Salary Survey 2025, average pay increases across the region are projected to hit +5.3% in 2026, marking steady optimism despite global uncertainty.

-

Vietnam leads the growth with an estimated 5–7% salary increase, driven by manufacturing, semiconductors, and digital services.

-

Indonesia and Philippines follow at 5–6%, buoyed by domestic consumption and nearshoring.

-

Singapore and Malaysia hover between 3.5–4.5%, reflecting mature, stable economies with slower wage inflation.

-

Thailand is forecasted at 4–5%, with recovery in tourism and retail hiring.

Vietnam’s strong FDI inflows, talent shortages, and a growing bilingual workforce make it a regional bright spot for wage competitiveness.

💼 2. Why Vietnam Continues to Outperform

Vietnam’s salary momentum stems from three structural advantages:

Expanding FDI and Supply Chain Realignment

Manufacturing and logistics firms are relocating operations from China to Vietnam. Sectors like semiconductors, green energy, and industrial automation are paying 10–15% higher for engineering and project management roles.

Bilingual Premiums Still Matter

Japanese and English-speaking professionals earn 10–20% salary premiums — a trend validated in Reeracoen’s 2025 Salary Guide. Employers see language fluency as essential for client interface and regional coordination.

Leadership & Retention Gaps

Vietnam’s scarcity of mid-level managers remains acute. Employers are budgeting additional 5–7% raises in 2026 to retain talent with both technical and leadership capabilities.

📊 3. Regional Benchmark Table (2026 Salary Growth Forecast)

(Sources: AON SEA Salary Survey 2025; Reeracoen Vietnam Salary Guide 2025; MoLISA Labour Market Report)

📈 4. What Employers Should Do

🔹 Benchmark smartly: Use percentile medians (P25–P75) from verified guides to maintain pay equity.

🔹 Reward bilingual expertise: Structure allowances (VND 3–8 million/month) or uplifts (+10–20%) to stay competitive.

🔹 Plan retention early: Invest in leadership development and structured training to close mid-tier talent gaps.

🔹 Localise pay strategy: Vietnam’s cost advantage still holds, but workers increasingly prioritise purpose, CSR, and growth over short-term pay.

💬 FAQ

Q1. Why are salaries rising faster in Vietnam?

Because of foreign investment and a shortage of skilled engineers and bilingual professionals.

Q2. Which industries will drive wage growth?

Manufacturing, IT/telecom, finance, and green energy lead 2026 increases.

Q3. How can employers manage rising costs?

Balance compensation with flexible benefits, training, and performance-based incentives.

Q4. Is Vietnam now the most competitive salary market in SEA?

Yes — for mid-level technical and bilingual roles, Vietnam now matches or surpasses Thailand and Malaysia in total compensation potential.

💼 For Employers: [Book a Consultation — Benchmark your 2026 compensation plans with Reeracoen Vietnam’s market data.]

👩💼 For Jobseekers: [Submit Your CV — Discover opportunities with Vietnam’s top-paying industries and companies.]

✅ Final Author Credit

- By Valerie Ong (Regional Marketing Manager)

-

Published by Reeracoen Vietnam — a leading recruitment agency in APAC.

🔗 Related Articles

📚 References

-

Reeracoen Vietnam Salary Guide 2025 (Data Window: Sep 2024 – Aug 2025)

-

AON Southeast Asia Salary Survey 2025

-

MoLISA Employment Outlook 2025

-

Reeracoen × Rakuten Insight APAC Workforce Whitepaper 2025

Disclaimer:

The information provided in our blog articles is intended for general informational purposes only. It is not a substitute for professional advice and should not be relied upon as such.

While we strive to provide accurate and up-to-date information, the ever-evolving nature of certain topics may result in content becoming outdated or inaccurate over time. Therefore, we recommend consulting with qualified professionals or experts in the respective fields for specific advice or guidance. Any actions taken based on the information contained in our blog articles are solely at the reader's discretion and risk. We do not assume any responsibility or liability for any loss, damage, or adverse consequences incurred as a result of such actions.

We may occasionally provide links to external websites or resources for further information or reference. These links are provided for convenience and do not imply endorsement or responsibility for the content or accuracy of these external sources. Our blog articles may also include personal opinions, views, or interpretations of the authors, which do not necessarily reflect the views of our organisation as a whole. We encourage readers to verify the accuracy and relevance of information presented in our blog articles and to seek professional advice when needed.

Your use of this website and its content constitutes acceptance of this disclaimer.